|

| A settlement has been reached between the City of Richmond and Hilltop Auto Mall dealerships in a dispute over business taxes. It is set for approval at the July 2 city council meeting.

Six Hilltop Auto Mall dealerships filed suit in 2022, claiming the rate structure under Measure U Gross Receipts Business Tax approved by voters in 2020 led to an unconstitutional 8,000 percent increase in taxes.

The negotiated agreement will create a new business class for automotive dealers and reduce business taxes by as much as half a million dollars. The settlement will also credit previous taxes paid over the next three years.

According to a report by Richmond City Attorney Dave Aleshire, the Hilltop dealers pay significant sales and other assessments to the city in addition to Measure U taxes and have the option to relocate their businesses to other cities.

Aleshire said the claims were defensible, but because the alleged violations are constitutional in nature, if the dealers were to prevail, they would likely be awarded attorney fees.

“The city decided a negotiated outcome was best and also wanted to deal with the whole category of auto dealers,” Aleshire wrote.

Before Measure U, dealerships paid about $14,000 per year based on the number of employees. In the first year, the taxes were calculated based on the dealership’s gross receipts. In 2022, taxes jumped to more than $1.1 million.

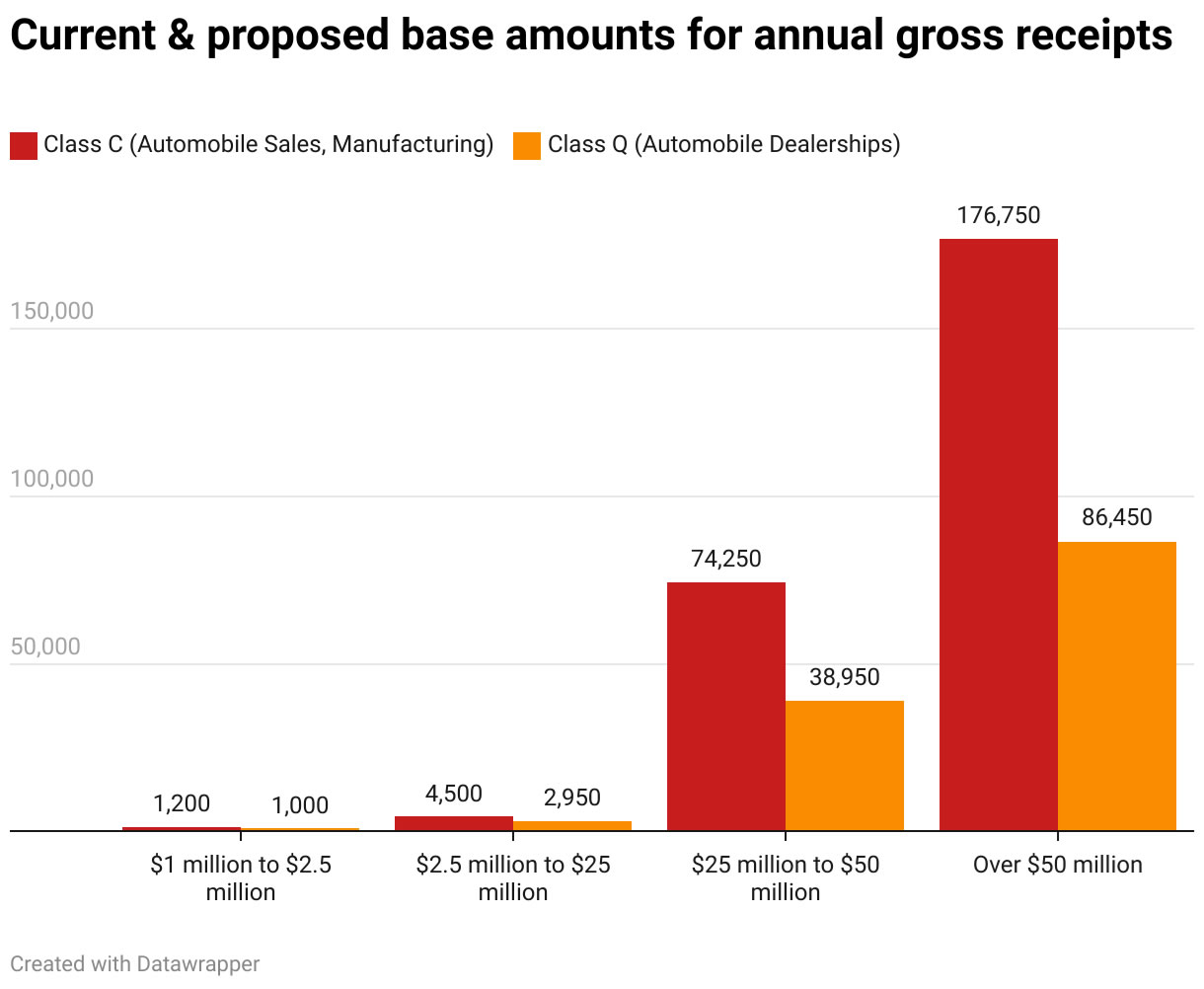

The new tax scheme has lower base amounts and lower amounts per $1,000 for each tier. For receipts under $1 million, the new tax is $1 per $1,000 instead of $1.20 per $1,000.

For receipts between $2.5 million and $25 million, the new tax is $2,950 plus $1.60 per $1,000 instead of $4,500 plus $3.10 per $1,000.

For receipts between $25 million and $50 million, the new tax is $38,950 plus $1.90 per $1,000 instead of $74,250 plus $4.10 per $1,000.

The new tax for receipts over $50 million is $86,450 plus $2.20 per $1,000 instead of $176,750 plus $5 per $1,000.

The city also agreed the dealerships will receive credit against future Measure U taxes for gross receipts generated in 2024, 2025, and 2026.

According to the report, on December 17, 2019, the mayor brought an item to the council, directing the city manager to explore potential revenue enhancement and cost-recovery measures based on the city’s structurally unbalanced budget.

“The city partnered with Lift Up Richmond to explore the feasibility of placing measures on the November 2020 ballot that would increase revenue,” Aleshire wrote.

Lift Up Richmond was a coalition of the unions that represents most Richmond city employees: SEIU Local 1021, Richmond Police Officers Association, IAFF Local 188, IFPTE Local 21, RYSE, Alliance of Californians for Community Empowerment, Asian Pacific Environmental Network, and other community and labor advocates.

On July 28, 2020, the City Council declared a fiscal emergency due to the city’s long-standing structural budget imbalance and the financial impacts of the pandemic.

Measure U was presented to the council again on July 28, 2020 which proposed that small businesses, any business generating less than $250,000 in sales, would only have to pay $100.

Within the business categories, the rates were structured on a progressive basis, with the higher the dollars in gross receipts, the higher the tax rate.

Measure U granted the city council the latitude to postpone its implementation, decrease the rates following its adoption, or add exemptions.

Measure U was approved and passed by voters on November 3, 2020, and went into effect on January 1, 2022. Attorneys for the city and the dealerships have been in negotiations to settle the lawsuit since it was filed in October 2022.

The city requested an independent third-party study of the economic claims of the Hilltop Group As the basis for negotiations.

This study by JS Held verified many of the claims in terms of industry profitability,” Aleshire wrote.

According to the most recent sales tax data available from 2020, Hanlees Hilltop Toyota had $63 million in gross sales and would have owed $246,170 under the Class C tax rate. Under the new tax rate, $63 million in sales would generate $116,992.

The Asian Pacific Environmental Network Action and SEIU Local 1021 have sponsored another tax for the November election.

The "Make Polluters Pay tax" business tax on oil refining would tax Chevron $1 per barrel of feedstock refined within the City of Richmond.

|