|

| The Kids First Debacle

This saga began with an initiative — Measure E, placed on the ballot through a signature-gathering process — that required in coming years up to 3 percent of the city’s general fund be set aside to pay for new programs serving youth. Using the FY 2017-2018 budget, that would have been about $4.6 million annually.

Measure E was sponsored by a coalition of youth-serving organizations, principally RYSE. The effort was funded with hundreds of thousands of dollars from foundations.

The money could be used for services and programs like recreation, violence prevention, health, environmental justice and deportation support. Existing city youth programs would not count toward the spending requirement.

That would mean that the city would somehow have to come up with new money or cut millions of dollars of other city programs and services, likely resulting in significant layoffs.

RYSE touted a poll showing 60% support for the measure, but there was a lot of pushback by City unions, the City Council and even the RPA.

RYSE feared a campaign financed by the opposition might defeat the measure, and the opponents feared Measure E might pass despite their opposition, so a grand bargain was struck.

Measure K was placed on the ballot by the City Council. It amended Measure E to require the additional spending on youth programs only if voters pass a general tax measure in a future election, and it eliminated some of the more egregious elements of Measure E, including a 20% limit on funding City-run programs. However, it did not require that revenues from the new tax measure be sufficient to cover the cost of the required new programs.

As it turned out, Measures E and K both passed

The original plan was to float a soda tax in November of 2018 as the general tax measure to pay for Kids First, but the California legislature preempted that option. The City Council then focused on raising the real estate transfer tax, but in considering options, they shied away from the more aggressive alternative of raising the tax on all transfers and instead limited it to those of over $1 million.

As the election neared, the required Financial Analysis by the finance director projected more than enough revenue to cover the cost of Kids First through at least FY 2025-2026, and probabbly thereafter. It looked like a win-win. Everybody was on board, including me. I even wrote ballot arguments in favor of the Measure H.

Following are the financial analyses of Measures E, K and H:

FINANCIAL ANALYSIS OF RICHMOND KIDS FIRST MEASURE (http://www.ci.richmond.ca.us/DocumentCenter/View/46018/FINANCIAL-ANALYSIS-OF-RICHMOND-KIDS-FIRST-MEASURE-2-Final?bidId=)

Finance Director’s Statement on the fiscal impact of this Measure: This Act is intended to complement and supplement the “Richmond Kids

First Initiative: The Richmond Fund for Children and Youth Act. ”Shall the Charter of the City of Richmond, if amended by passage of the Kids First Initiative, be further amended to: revise the dates in the Kids First Initiative to reflect implementation on July 1, 2018, remove the 20% restriction on funding to public entities to perform the services specified in the Kids First Initiative, and provide that funding obligations beginning on July 1, 2021, are contingent on passage of a general tax measure for the City of Richmond?”

The required amounts of funding to be set aside in each fiscal year (FY) from the City’s General Fund into the Kids First Fund would be as follows:

- FY 2021-2022 - $250,000

- FY 2022-2023 - $700,000

- FY 2023-2024 - 1% of the City’s annual actual unrestricted general purpose revenues (“Annual General Revenues”)

- FY 2024-2025 - 2% of the Annual General Revenues

- FY 2025-2026, and each fiscal year thereafter through FY 2031-2032 - 3% of the annual general revenues

These funding obligations are contingent on the passage by voters of a new general tax measure. Based on the current year projected revenues for FY 2017/18, the following are the potential amounts of Kids First set-aside obligations at the 1%; 2%; and 3% levels: 1% - $1,544,252, 2% - $3,088,503, 3% - $4,632,755. To meet these set-aside obligations, current programs and services may need to be reduced, but only by any amount not offset by a new tax measure. These estimates are based on current years’ activity and may not be predictive of future revenues.

Belinda Warner

Finance Director City of Richmond

FINANCIAL ANALYSIS OF DOCUMENTARY TRANSFER TAX INITIATIVE Finance Director’s Statement on the fiscal impact of the Documentary Transfer Tax Initiative (https://www.ci.richmond.ca.us/DocumentCenter/View/47265/Measure-H---FINANCIAL-ANALYSIS-OF-DOCUMENTARY-TRANSFER-TAX-INITIATIVE---RESO-71-18---081018):

If the proposed ordinance is approved by the voters, in my opinion, it would generate additional tax revenue for the City that can be used for any public purpose. The ordinance would increase the property transfer tax rate on transactions of properties with sale prices between $1,000,000 and $3,000,000 from 0.7% to 1.25%, and the rate on transactions of properties with sale prices between $3,000,000 and $10,000,000 from 0.7% to 2.5% and the rate on transactions of properties with sale prices $10,000,000 and above from 0.7% to 3%. Properties with sale prices between zero and $1,000,000 will remain at the current rate of 0.7%.

Based on the actual pattern of transactions and revenues received by the City through the property transfer tax, had the proposed ordinance been in place during the period from fiscal year 2015-2016 through fiscal year 2017-2018, it would have resulted in additional annual revenue ranging from $4 million to $6.5 million. An average amount of $4.8 million annually would have been generated during that period.

While we estimate that the proposed ordinance would have resulted in average additional revenue of $4.8 million per year in the recent past, it is important to note that this is the City’s most volatile revenue source. Estimates based on prior years’ activity may not be predictive of future revenues.

Belinda Warner Finance Director City of Richmond

As it turned out, the finance directors projections were wildly flawed, but in all fairness, she included the caveat, “it is important to note that this is the City’s most volatile revenue source. Estimates based on prior years’ activity may not be predictive of future revenues.”

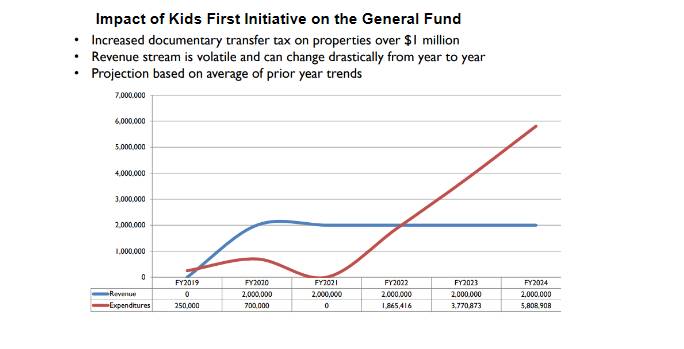

When the 2019-2020 Budget was adopted in June of 2019, it included the projection shown below, less than a year after the same finance director predicted more than sufficient funding for Kids First.

Figure 1 -http://www.ci.richmond.ca.us/DocumentCenter/View/50308/Adopted-FY2019-2020-Operating-Budget

The table below compares the original projections of the finance director in 2018 compared to the most recent 2019 projections for revenue and expenses related to Kids First.

|

FY 2018-2019 |

FY 2019-2021 |

FY 2020-2021 |

FY 2021-2022 |

FY 2022-2023 |

FY 2023-2024 (1%) |

FY 2024-2025 (2%) |

FY 2025-2026 (3%) |

Costs Projected by Measure H Financial Analysis(1) |

|

|

|

$250,000 |

$700,000 |

$1,544,252 |

$3,088,503 |

$,4, 632,755 |

Revenue Projected by Measure H Financial Analysis(1) |

|

|

|

$4,000,000 to $6,500,00

Average = $4,800,000 |

$4,000,000 to $6,500,00

Average = $4,800,000 |

$4,000,000 to $6,500,00

Average = $4,800,000 |

$4,000,000 to $6,500,00

Average = $4,800,000 |

$4,000,000 to $6,500,000

Average = $4,800,000 |

Surplus/(Shortfall) |

|

|

|

$3,750,000 to $6,250,000 |

$3,300,000 to $5,800,000 |

$2,455,748 to $4,955,748 |

$911,497 to $3,411,497 |

($632,755) to $1,867,245 |

|

|

|

|

|

|

|

|

|

Costs Projected by 2019-2020 Budget |

$250,000 |

$750,000 |

$0 |

$1,865,416 |

$3,770,873 |

$5,808,908 |

|

|

Revenue Projected by 2019-2020 Budget |

$0 |

$2,000,000 |

$2,000,000 |

$2,000,000 |

$2,000,000 |

$2,000,000 |

$2,000,000 |

$2,000,000 |

Surplus/(Shortfall) |

($250,000) |

$1,250,000 |

$2,000,000 |

$134,584 |

($1,770,873) |

($3,808,908) |

No Projection |

No Projection |

- Based on fiscal year 2015-2016 through fiscal year 2017-2018

By Fiscal Year 2023-2024, the annual shortfall for Kids First is projected to be $3,808,908 and the cumulative net shortfall $2,445,197.

This could be fixed by yet another ballot measure that simply limits Kids First expenditures to the annual revenue raised by Measure H. |