|

|

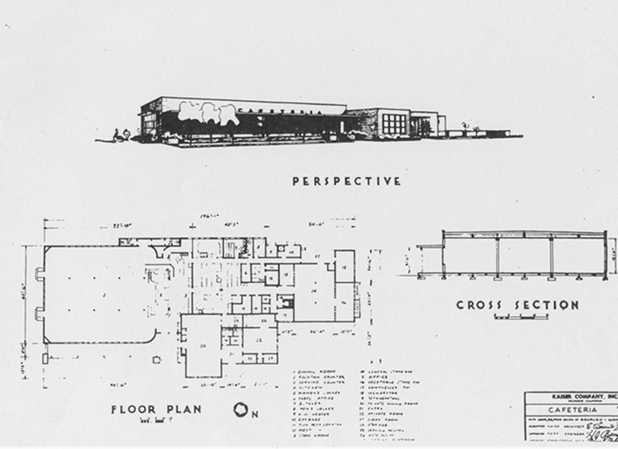

The RFP for the historic 14,000 square foot building is available at https://www.dropbox.com/s/2mk71b80w5sf9cw/~Cafeteria-RFP-r.pdf?dl=0.

To receive official information, login at https://www.planetbids.com/portal/portal.cfm?CompanyID=14590#

CAFETERIA BUILDING

The structure is in a Historic District as defined in the new Zoning Ordinance. The following findings were provided by Richard in response to the question about uses allowed within the IW zone:

Assuming the specific site(s) are covered by the -H or-L Historic Overlay (They are part of the Richmond Shipyard District), language in 15.04.303.100 “Historic Districts and Landmarks overly Districts” allows the Planning Commission to grant exceptions to the land use regulations with a Conditional Use Permit. This can be done by preparing a Historic Conservation Plan that can provide details that explain how the proposed use can facilitate or support rehabilitation of the historic asset.

Richard confirmed that the existing language allows alternative land uses to be proposed for these structures without any additions or revisions to the Zoning code. Additionally Resolution 16-11 sets an important precedent to justify land use exceptions for the historic structures at Shipyard 3.

Theoretically, the City could sell it, but I think we would rather do a long-term lease, for as much as 39 years or more, which would allow the lessee to capture historic preservation tax credits. The lessee can also benefit from a Mills Act Contract and use of the California Historic Building Code, all of which add value to the property because they work to lower development costs by at least 20% or more compared to a non-historic comparable property.

If this were a sale, the residual value of the existing property would be at least $1 million to $1.5 million. If it costs $2.1 million to rehab, that’s $150/SF. If it were already rehabbed, it would be worth about $250/SF, so the residual value is around $100/SF, or $1.400,000. Remember, it has extensive, already improved, on-site parking.

The City would prefer a long-term lease with a requirement that the owner fully rehabilitate and operate the property for a use that includes a reasonable level of public access in at least part of the building, such as a bar, restaurant, gallery, meeting space, etc.

Here are some potential deal points for a long-term lease:

- Land lease begins immediately. 87,120 SF (approximately) at $0.10/SF /month = $8,712/month or $104,544/year. First year paid on closing.

- Preliminary description of project concept approved by City must, at a minimum, conform to the Secretary of Interior’s Standards.

- Term: Minimum 39 years

- Annual CPI escalator

- Mandatory development schedule, failure to stay on schedule results in default at City’s discretion.

- Failure to operate the building as a going concern results in default at City’s discretion.

- If one or more additional buildings are built on the property, the lease payment can be renegotiated.

Potential Development Schedule Requirements

Months |

Work Product |

0 |

Insurance, security plan |

2 |

Select and contract with Design Team, including qualified preservation architect |

3 |

Tax Credit Certification application Part 1 |

6 |

Design concept and preliminary cost estimate |

8 |

Submit for Design Review and CUP |

12 |

Submit for building permit, Tax credit certification Part 2 |

14 |

Start construction |

24 |

Substantial completion of construction, occupancy permit, tax credit certification Part 3 |

|

|

The exterior of the building will have to be rehabilitated in conformance with the Secretary of the Interior’s Standards. Fortunately, it has changed little since 1943. There is much flexibility on most of the interior. The Riggers Loft is a good example.

If the building were rehabilitated to a cold shell with rough utilities, it might be worth about $2.5 to $3 million, maybe $3.5 to $4 million as warm shell.

To rehabilitate the building to a “cold” shell:

System |

SF |

Cost/SF |

Subtotal |

Roof, including diaphragm, insulation membrane and flashing |

14,000 |

30 |

420,000 |

Mechanical/Plumbing |

14,000 |

35 |

490,000 |

Electrical |

14,000 |

25 |

350,000 |

Shell |

14,000 |

20 |

280,000 |

|

|

|

1,540,000 |

To rehabilitate to a “warm” shell

System |

SF |

Cost/SF |

Subtotal |

Roof, including diaphragm, insulation membrane and flashing |

14,000 |

30 |

420,000 |

Mechanical/Plumbing |

14,000 |

50 |

700,000 |

Electrical |

14,000 |

50 |

700,000 |

Shell |

14,000 |

20 |

280,000 |

|

|

|

2,100,000 |

If the property is sold, a new owner rehabilitating it can claim a 20% Historic Preservation Tax Credit (https://www.nps.gov/tps/tax-incentives/taxdocs/about-tax-incentives-2012.pdf), as can a lessee with at least a 39-year lease. A tax credit is essentially a discount, for example, reducing a $1 million construction cost only $800,000. An owner can also seek a Mills Act contact and use the California Historical Building Code to save money. |