|

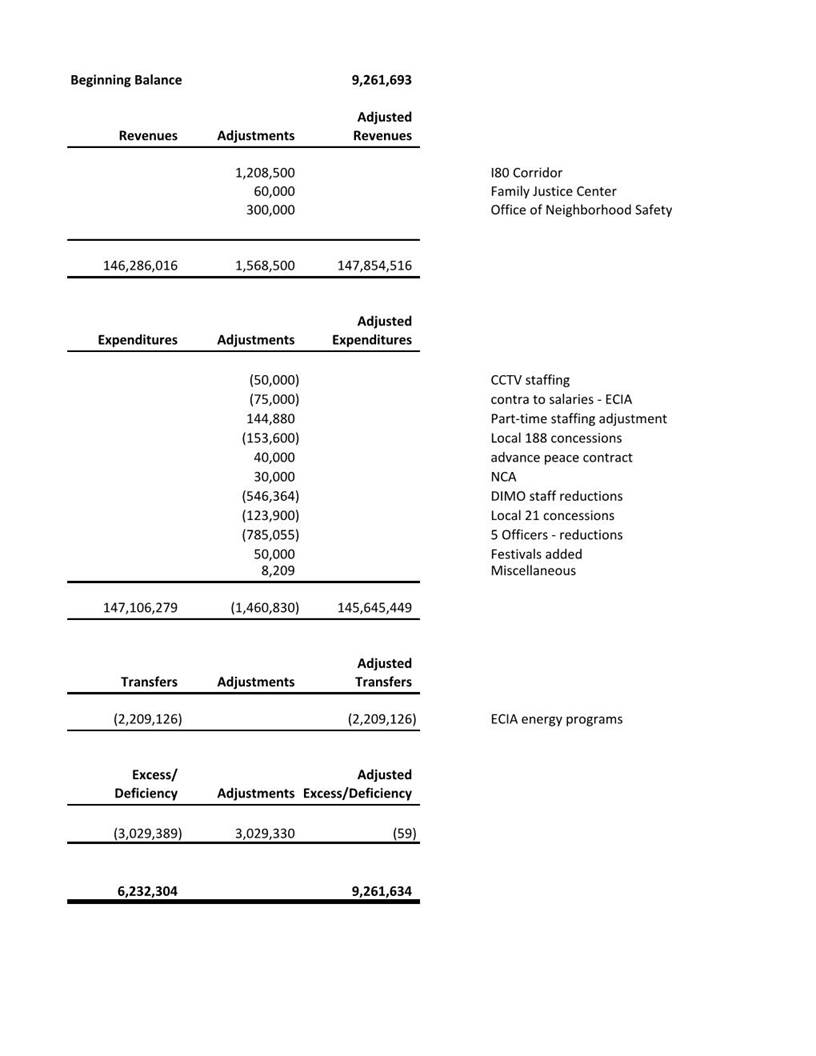

| Tomorrow night, the City Council will consider a structurally balanced budget of $147,854,516 presented by the city manager (see Item 1 below) and Agenda Item I-1, REVIEW, DISCUSS, and ADOPT the proposed Fiscal Year 2016-17 Annual Operating Budget and the Fiscal Years 2016-21 Five-Year Capital Improvement Budget; or provide additional direction to staff - City Manager's Office and Finance Department (Bill Lindsay 620-6512/Belinda Warner 620-6740). The proposed budget has cuts to programs and services that no one likes (See Richmond Inches Towards a Balanced FY 2016-17 Budget, June 15, 2016), but they have to be done.

There will be opportunities to increase revenue in the future, including taxation of Marijuana cultivation and manufacturing businesses and adoption by the voters of initiatives to raise the real estate transfer tax and establish a litter tax. There are also threats, including approval by voters of the Rent Control initiative and the Kids First initiative.

The Richmond Progressive Alliance (RPA) City Council members continue to advocate for a cost reduction proposal (Item 3, below) that has the higher paid City employees voluntarily taking pay cuts, many of which would be significant. Regardless of how good an idea anyone thinks this is, it is a non-starter for several reasons:

· It could not be implemented in time to affect the 2016-17 budget.

· It has already been rejected by the City Council.

· There is no evidence that City employees would accept it.

Conceptually, the most significant flaw is that like any business, a city has to remain competitive in compensation to attract competent employees. Wholesale, and drastic, reductions to compensation, especially for police, fire, department heads, assistant city attorneys and other well-compensation employees would result in a large number of employees looking for and securing jobs elsewhere. These kinds of measures may be possible in dictatorships, but they are virtually impossible in our type of government.

Half of the City’s principal bargaining units have already agreed to the increased contribution to the OPEB (Other Post-Employment Benefits), an important step in achieving a balanced budget.

Related to the budget discussions are ongoing media and social media discussions about how the City of Richmond spends more for city services than other cities, particularly Concord, a city of similar size in Contra Costa County. You couldn’t pick a more apples and oranges comparison than Richmond and Concord. As discussed in Response to "Richmond's compensation is driving its budget deficit (East Bay Times guest commentary)," May 27, 2016, Concord does not operate a fire department, employment and training department, housing authority or a library, all of which are operated for Concord by Contra Costa County and paid for by the County’s share of taxes rather than the city’s. Richmond receives additional tax revenue and revenue from other sources to provide these services. Concord also has only one swimming pool; Richmond has two. Concord has only one senior center; Richmond has two. Concord has only one community center; Richmond has at least five, six if you count the Disabled Personas’ Recreation Center. Concord has no branch libraries; Richmond has two. Our residents simply demand a higher level and more distributed of services than do Concord’s.

One place that Richmond stands out from many other cities is the relative amount of the police budget. When many cities cut their police budget, and consequently the number of officers, during the recession, Richmond did not. One of the results is that Richmond disappeared from the list of the ten most dangerous cities in the U.S. and in California. Those Bay Area cities that made cuts are now on the latest list of California’s ten most dangerous cities, including Stockton (2), Vallejo (4), Oakland (6) and Antioch (7). We believe Richmond residents would rather be safe than unnecessarily frugal.

Item 1 - City Manager’s Proposed Budget Worksheet for a Balanced Budget

Item 2 – Effects of RPA Proposed Compensation Cuts

Salary Saving by Graduated Percentage Reduction |

|

|

Salary Threshold |

Percentage |

Employees Affected |

Salary Saving |

|

<60,000 |

0% |

112 |

$ - |

|

60,000-80,000 |

1% |

184 |

$ 127,275 |

|

80,000-90,000 |

2% |

68 |

$ 118,200 |

|

100,000 |

4% |

81 |

$ 330,495 |

|

110,000 |

6% |

147 |

$ 995,528 |

|

120,000 |

8% |

43 |

$ 405,668 |

|

130,000 |

10% |

45 |

$ 593,556 |

|

140,000 |

12% |

26 |

$ 431,750 |

|

150,000 |

14% |

3 |

$ 64,115 |

|

160,000 |

16% |

17 |

$ 427,388 |

|

170,000 |

18% |

4 |

$ 122,545 |

|

180,000 |

20% |

5 |

$ 179,873 |

|

190,000 |

22% |

2 |

$ 81,953 |

|

200,000 |

24% |

3 |

$ 145,245 |

|

210,000 |

26% |

1 |

$ 55,614 |

|

220,000 |

28% |

1 |

$ 62,184 |

|

230,000 |

30% |

0 |

$ - |

|

240,000 |

32% |

1 |

$ 75,418 |

|

250,000 |

34% |

0 |

$ - |

|

260,000 |

36% |

0 |

$ - |

|

270,000 |

38% |

1 |

$ 102,817 |

|

Total |

|

744 |

$ 4,319,624 |

|

|

|

|

|

|

Assumptions |

|

|

|

|

-The analysis is covers only full time/part time permanent positions |

|

-Reference salaries are rounded to the nearest multiple of 10K to determine the appropriate reduction percentage |

|

Item 3 – RPA Salary Reduction Proposal

Dear Friends:

Below is an article from me, along with Vice-Mayor Martinez and Councilmember Beckles. Sincerely, Gayle

Proposed Cuts in Richmond Budget Magnify Inequality

The City of Richmond is currently engaged in finalizing our Fiscal Year 2016/2017 budget. We have some challenges due to the fact that Richmond has yet to recover from the recession. We have been working hard to come up with ideas to lessen the impact on our community, while still offering a structurally balanced budget. The RPA has always been an organization that stands for equity. How does one get equity? While some may still think that "trickle down" economics work, many of us think otherwise. It's important to note that Richmond's low-income community continues to struggle with making ends meet for basic survival needs (food, housing, jobs, healthcare, education, child care, etc.). While the City has expanded services in recent years, the situation going forward has some challenges. While other cities in the region have rebounded from the recession, property values in our city have been slow to rise, and of course the cost of living (including the cost to run a city) has indeed gone up considerably.

On June 14st, the city council voted to approve some service cuts (to begin to close the budget gap, though a $2.9 million gap remains ). The vote was 4-3 in favor of the cuts. The three of us (Vice Mayor Martinez and Councilmembers Beckles and McLaughlin) did not support those cuts. Instead, the concept of graduated salary reductions had been presented to avoid either layoffs or cutbacks in services that are badly needed by our residents. An example of this concept was to have 'no reductions' at the lower end of the scale and progressively more reductions for higher salaries. These reductions would be temporary and would be fully restored to previous levels when the general fund revenue has increased. A suggested "starting point" for discussions among all the staff was presented as below:

0% reduction for salaries up to 60K

1% reduction for salaries between 60-80K

2% reduction for salaries between 80-90K

And another 2% more for each additional 10K

This would have yielded 4.3 million in savings. Again, this was just a starting point for discussion, but it was not received favorably among some in the City. It has been stated that this idea came from SEIU 1021, but that is in fact not true. It is unclear as to the position of SEIU 1021, since this has yet to be taken up by them.

Since this idea was presented when we had over a 4.6 million dollar gap, and the gap is now 2.9 million, it seems a smaller percentage of salary reductions would close the gap. If the percentages were cut in half starting with a .5% increase at the range of 60-80k and going up to 1% for 80-90k, and another 1% for every additional 10k, we would still have 2.3 million in savings. This would be a considerable savings without deepening the impacts to services.

Instead, what City staff and some members of the Council are saying is that the remaining $2.9 million gap in the budget will have to come largely from either additional employee contributions for OPEB (Other Post-Employment Benefits, i.e. health insurance) or from layoffs. OPEB contributions must be negotiated with bargaining units and it is unclear if all the bargaining units will agree to this. And it doesn't make sense to layoff more employees, given that our staffing level has been reduced substantially over the recession period, and we are already short-staffed to carry out the services needed by our residents. So it continues to make sense to many of us to establish temporary graduated salary reductions.

There are examples in the private sector where some private businesses have established such a graduated salary reduction scale. A perfect example is in Mondragon, Spain, where the Mondragon Corporation, a corporation and federation of worker cooperatives, decided collectively to take progressive salary cuts, rather than layoff people during hard times. This strategy has allowed them to thrive and grow to becoming the tenth-largest Spanish company in terms of asset turnover and the leading business group in the Basque Country of Spain. At the end of 2014, it employed 74,117 people in 257 companies and organizations in four areas of activity: finance, industry, retail and knowledge. But it did require people to work together and look out for one another.

City officials may believe they are looking out for residents by cutting city services to provide a balanced budget, but this ends up balancing the budget on the backs of our community at large, and that is not a just and equitable way to proceed, especially in a community that has such a large low-income population. This pathway of cutting city services, and potentially laying off city staff, will not bring us closer to a just and equitable Richmond.

While it would be great if our current society promoted social mobility where people can rise in terms of their economic well-being, this has not been the case in the US for many decades. New thinking needs to be utilized. It is incumbent on progressives to promote real solutions that better the lives of our community even if those with higher incomes have to take temporarily a small cut in their salaries.

In suggesting these short-term salary reductions, we are not saying that salaries are too high. For most of Richmond's employees they are too low to keep up with the cost of living that is going up so rapidly. That is why we proposed temporary reductions and a trigger to restore them.

The main problem is that there has been a rapid shift of wealth to the 1% in the past decades, accompanied by increased political power by this 1%. The real solution for cities is for this wealth to be taxed at the state and national level and for this increased tax revenue to be used for programs to rebuild our cities. A start would be fixing the loopholes for corporations in Proposition 13 and a real permanent tax on millionaire income. We need to work with progressive organizations, unions and cities to achieve these. Until we get a just tax system, we will have to take steps like the ones we propose here to make sure that we do not continue to magnify the inequality.

Vice-Mayor Eduardo Martinez

Councilmember Gayle McLaughlin

Councilmember Jovanka Beckles

|

|