|

| Once again, Borenstein has it wrong.

· It would not be the “highest property transfer tax in the state.” It would actually be less than either Oakland or Berkeley.

· The incremental tax on a $500,000 sale would be $4,000 (.008 x $500,000), not the $8,050 that Borenstein claims.

· Borenstein states, “Two years ago, Richmond leaders persuaded voters to approve a sales tax hike by suggesting the money would go to road repairs. Instead it was gobbled up by ongoing expenses.” Measure U was a general tax. That it was somehow hijacked is an urban myth that anti-tax advocates like Borenstein continue to spread. The City’s website before the election stated: “What is Measure U? A ballot measure proposing a one-half cent sales tax to maintain and enhance essential city services, such as public safety, public health and wellness programs, city youth programs and street paving.” The actual title for Measure U that appeared on the ballot contained 36 words, only two of which mentioned “street paving.” (Shall the City of Richmond adopt a one-half cent transactions and use (sales) tax, to fund and maintain essential city services, such as public safety, public health and wellness programs, city youth programs and street paving?) In fact, the first year’s proceeds from Measure U were used for all these things (“essential city services, such as public safety, public health and wellness programs, city youth programs and street paving”). The budget for street maintenance in this year (FY 2015-16) was substantially increased from FY 2014-15. The East Bay Times could have looked at the budget (http://www.ci.richmond.ca.us/DocumentCenter/View/34458) and found, for example, that the number of “city blocks resurfaced” rose from 80 to 96, and the number of potholes filled from 2,100 to 3,000. The Pavement Condition Index (PCI) was projected to rise from 62 to 63. The only thing the City did not do, with an abundance of caution, was to immediately float a bond for street repairs that would have tied up Measure U revenue for many years to come.

Although not a factual error, Borenstein’s implied criticism, “Measure M money would probably go toward city employee compensation,” makes no sense. Most of what cities do is done by paying city employees to do it, like cops, firefighters, librarians and street repair workers. They have to be paid, and that’s “employee compensation.” If Borenstein knows where we can buy public safety or better streets without paying someone, I would like to hear it.

As I have said many times, I appreciate Borenstein’s one-man war against unpaid pension tax liabilities. Almost every government agency in California is going to have to deal with this inconvenient truth. Richmond is not unique.

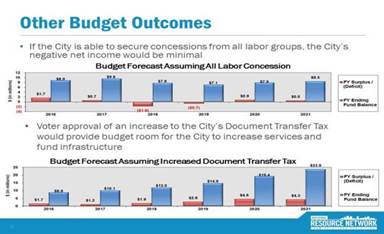

But meanwhile, we have a city to run and a budget to balance, and our consultant from the National Resource Network, Russ Branson, has recommended the transfer tax increase as one tool to make it work. Note the slide below, “Looking toward voter-approved tax rate increases, such as the documentary transfer tax, could provide the City the opportunity to meet its long-term financial goals.”

The transfer tax only affects property owners, which leaves out about half of Richmond’s population. And it is not paid annually like property taxes; it is a one-time tax that is paid only when there is a sale.

As a critic, Borenstein enjoys the luxury of only having to deal with only one-half of the municipal finance challenge. The other half, what to cut to get to Borenstein’s tax slashing utopia, is the really hard work. Just once, I hope Borenstein would help us out by suggesting exactly what services should be cut to balance the budget and pay off pension liabilities.

Vote for Measure M. See http://tombutt.com/forum/2016/16-10-9.html.

Borenstein: Richmond tax would be 15 times statewide norm

Borenstein: Richmond tax would be 15 times statewide norm

By Daniel Borenstein | dborenstein@bayareanewsgroup.com

PUBLISHED: October 20, 2016 at 9:07 pm | UPDATED: October 21, 2016 at 9:56 am

The Richmond City Council wants to charge homeowners the highest property transfer tax rate in the state, nearly 15 times what most Californians pay.

Measure M on the Nov. 8 ballot would grab homeowners’ hard-earned equity to compensate for Richmond officials’ inability to competently manage city finances.

In most of the state, the sale of a $500,000 house would generate a $550 transfer tax to cover the government cost of paperwork. In Richmond, if Measure M passes, the fee for that same $500,000 sale would be $8,050.

Richmond Mayor Tom Butt (Anda Chu/Bay Area News Group)

Mayor Tom Butt portrays this as a way to stick it to the man, the greedy banks that foreclose on homes. In fact, it would hurt most hardworking men and women trying to invest in the dream of homeownership.

In a recent widely distributed e-mail, Butt claimed that “96 percent of homeowners are paying nothing and are not affected by real estate transfer taxes.”

That’s just wrong. Real estate transfer taxes affect all property owners who sell their homes before they die. The money comes right out of the buyer’s or seller’s equity, the funds remaining after the mortgage is paid off.

It’s ironic this plan comes from Richmond, where city officials previously unsuccessfully floated a questionable scheme to bail out homeowners underwater on their mortgages. Measure M would effectively add thousands of dollars more debt to struggling homeowners.

Richmond, a working-class city with large pockets of poverty, already has some of the highest annual property tax rates in the East Bay.

That’s in part because property owners pay for the West Contra Costa school district’s excessively expensive construction program and the city’s unusual and costly tax to fund public employee pensions.

Now City Council members want to add insult to injury by taking an exceptionally large cut of proceeds from property sales.

Butt concocted this scheme, which was supported by the Richmond Progressive Alliance council members. Vinay Pimplé and Nat Bates were the only council members opposed.

In most California cities, the proposed tax would be illegal. Most cities operate under general state laws for municipalities that limit the transfer tax rate to $1.10 for every $1,000 of sale price.

But cities with their own charters, like Richmond, are not bound by that. They can set higher transfer taxes. Twenty-seven cities have done so.

Richmond already has a rate of $8.10 per $1,000 of sale price. Of that, $7 goes to the city and $1.10 goes to the county.

Measure M asks voters to increase the city’s share to $10 per $1,000 of sale price for property that sells for less than $400,000.

And for property that sells for more, the city rate would be $15 per $1,000 of sale price. Combined with the county share, the total would be $16.10 per $1,000.

According to Richmond officials, 71 percent of the properties sold in 2015 went for more than $400,000.

The only other cities in the state that charge such high fees are Oakland and Berkeley. San Francisco charges less than half the $16.10 rate for properties under $5 million, but exceeds it for higher sale prices.

Butt says the city needs the tax to shore up city finances. Indeed, city officials must come up with more revenues and cut expenses. They need to close a $15 million gap over the next four years to have minimal budget reserves for emergencies.

And that doesn’t allow for making minimum annual payments on retirement debt, fixing crumbling roads or performing proper upkeep of city buildings and parks. Those huge liabilities will keep growing if city officials continue to ignore them.

Two years ago, Richmond leaders persuaded voters to approve a sales tax hike by suggesting the money would go to road repairs. Instead it was gobbled up by ongoing expenses.

Now they want more taxes. This time Butt says Measure M money would probably go toward city employee compensation. He’s dropped any pretense it will be used otherwise.

Meanwhile, city officials apparently just want to hope the mounting debt will go away — or they’ll propose another tax for that.

|

|