| |

A On November 9, 2015, the second Contra Costa Times column (See Daniel Borenstein: Richmond city manager blocked release of report forecasting city's financial fall, November 7, 2015) by Dan Borenstein in two days hit the presses, predicting that the fiscal sky over Richmond is falling.

Today, Karina Ioffee, also of the Contra Costa Times piled on with “Facing heat from creditors, Richmond tries to shore up finances.” And even Richmond Standard had to get its licks in with “Richmond Councilmember Vinay Pimple pushes for fiscal transparency,” also out today.

Bates and Pimple are being characterized by the media as budget hawks, but neither has proposed exactly which projects and programs they would cut for immediate relief. Pimple has focused on a $1,000 (maximum) park bench, which I understand will be paid for by a grant or gift, not by the general fund.

Borenstein and the bond raters may not like the way it was done, but City Manager Bill Lindsay delivered a budget surplus for FY2014-15, and the budget for FY 2015-16 is balanced. It may not be pretty, but it’s not bloody.

Dan is my go-to person for pensions, and he is very good at what he does, but that is unfortunately limited to numbers and reading bond raters’ reports. For Borenstein, the sun rises and sets based on what Moody’s and S&P write about a city’s creditworthiness and by the magnitude of a City’s unfunded pension and OPEB liabilities. While these are clearly important, they are just one of the complex factors involved in running an effective city government. As an investigative journalist, Borenstein should also take a look at the credibility of the bond raters themselves, which would probably qualify for less than junk if such a rating system existed.

Both Moody’s and S&P have been investigated for decades for manipulating credit ratings to shake down municipal governments (http://www.wsj.com/articles/SB921197561149784842):

"The civil inquiry, launched in 1996, examined one of the most controversial issues in the bond-rating business: the use of "unsolicited ratings," or ratings issued without the consent of bond issuers. Most bond ratings are issued with the consent of the municipality or company selling bonds. The company, city or state pays a fee to a credit-rating company, which publishes a rating, often in the form of a letter grade, for the investing public.

But in recent years, issuers have begun to shop for the lowest prices among the agencies that rate debt. Putting Moody's in the Justice Department's cross hairs were allegations by some bond issuers that Moody's fought this trend by threatening to issue lower, unsolicited ratings to prod bond issuers into buying its assessments.

Moody's, which along with McGraw-Hill Cos.' Standard & Poor's rating unit had dominated the ratings business, all along denied the charges. But the inquiry threatened to shake up the secretive and highly lucrative bond-rating business, where profit margins are huge and negotiations between issuers and bond raters aren't open to the public."

The Department of Justice settled with S&P in February of 2015 for $1.375 billion or defrauding investors in the lead up to the financial crises, and they are continuing an investigation into Moody’s for the same thing.

“What we found at Moody’s was very similar to the practices and conduct at Standard & Poor’s. The conduct and results were the same,” said Mr. Angelides. The 10-member [Financial Crisis Inquiry] commission concluded that credit-rating firms were “essential cogs in the wheel of financial destruction.”

In contrast with big Wall Street banks that have paid more than $100 billion to settle postcrisis lawsuits, credit-rating firms have mostly escaped the surge of legal scrutiny and regulatory changes.

The Richmond “crisis” that Borenstein and the Contra Costa Times continue to manufacture and nurture revolves around the refinancing of bonds involved in a swap where a Moody’s downgrade has triggered a right by the counterparty JP Morgan/Chase, to call the bonds. City staff and bond consultants have been hard at work the last several weeks and have crafted a solution that will be on the City Council’s November 17 agenda. The solution will take both JP Morgan/Chase and Moody’s out of the picture for Richmond, reduce the chance of an adverse S&P rating affecting Richmond and position the City for significant future savings in three years related to a potential refinancing of the Civic Center bonds. See Item D-1 on the November 17 Agenda.

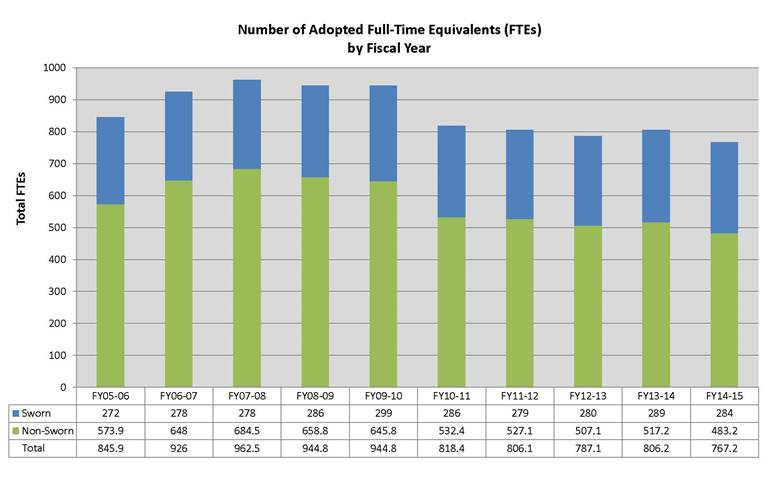

Meanwhile, City Manager Bill Lindsay is continuing to move the City of Richmond towards more liquidity and increased reserves, the issues that seem to impress bond raters the most. Squeezing more money out for liquidity and reserves means increasing revenue and/or decreasing expenditures. The City’s largest expenditure is for labor, and the city manager has been downsizing Richmond’s number of FTE (full-time equivalent) employees since the peak of FY 2007-08. The total has dropped from 962.5 in FY 2007-08 to 700 in November 2015, a remarkable 27% reduction.

On the other side of the equation, revenues are based largely on property taxes, utility user taxes and sales taxes. Both property taxes and sales taxes continue to trend upwards, and utility user taxes are holding at least steady because they are affected by increased energy conservation efforts of both businesses and residents, something that is also reducing the City of Richmond’s operating costs.

Zillow shows a 15.1% change in Richmond home values in the last year, and forecasts a 4.5% increase in the coming year. Richmond foreclosures are the lowest since 2006. Commercial property values and rental rates are up, and vacancies are down. See Cushman & Wakefield Third Quarter Report. More Richmond residents are employed than ever before, and the City’s unemployment rate is as low as it has ever been.

Meanwhile, residents are increasingly impressed with Richmond. In the five semi-annual National Citizen Surveys conducted since 2007, Richmond residents have rated Overall Quality of Life improving 82%, Overall Image improving 100%, Richmond as a Place to Live by 105%, Neighborhoods by 14%, A Place to Raise Children by 100% and Overall Appearance by 112%.

On September 29. 2015, the City Council approved a contract with the National Resource Network, a program of the White House, to provide $110,000 of technical assistance to the City of Richmond (of which the City had to fund only $27,500) to construct a sophisticated, interactive 5-year budget forecasting model. This will be introduced to the City Council and the community in the next 60 days and can be used to explore alternative fiscal futures.

This is not, as Borenstein would have you believe, “ a slow moving train wreck.” This is taking a responsible look at City priorities and public policy options.

Lindsay’s contract expires in February 2016 and is up for renewal on November 17, 2015. There has been some grumbling about a few things that are imperfect, including the drawn out evacuation of the Hacienda, Measure U and the bond ratings. Malcontents are complaining that Measure U proceeds were diverted from street paving to balance the budget. Read the official description of Measure U, which states, “A ballot measure proposing a one-half cent sales tax to maintain and enhance essential city services, such as public safety, public health and wellness programs, city youth programs and street paving.” Street paving is only one of five stated purposes. Measure U has no sunset ,and there is plenty of time to use proceeds for street paving in future years.

Vacation of the Hacienda has been fully funded and HUD approved for months and is proceeding as fast as it can. Other issues with HUD left over from dissolution of Redevelopment have been largely resolved.

In the ten years since Bill Lindsay came to Richmond as city manager, the City has changed dramatically for the better under his leadership and under an independent and progressive city council. It is essential that we not be distracted by media chicken littles and budget hawks. We need to renew Lindsay’s contract for another four years and continue this unprecedented journey to a better City of Richmond.

Tom Butt

Contra Costa Times editorial: To avert disaster, Richmond must apply the fiscal brakes -- now

Contra Costa Times editorial © 2015 Bay Area News Group

Posted: 11/08/2015 08:00:00 AM PST

Updated: 11/09/2015 02:29:18 PM PST

Mayor Tom Butt speaks at the Richmond Memorial Auditorium and Convention Center in Richmond, Calif., on Tuesday, Jan. 13, 2015. (Jane Tyska/Bay Area News Group)

Watching Richmond officials deal with city finances is like viewing a slow-motion train wreck. Let's hope someone applies the brakes quickly.

Unfortunately, it probably won't be City Manager Bill Lindsay, who insists, wrongly, that the budget is structurally balanced. It won't be Mayor Tom Butt or Councilwoman Gayle McLaughlin, who parrot that false claim.

Two major rating agencies have slammed the city's fiscal management. Of the 68 California cities rated by Moody's Investors Service, only Richmond has been dropped to junk-bond status.

Standard & Poor's reduced its Richmond rating to just above junk-bond level. That also signals greater risk to investors, which in turn means the city will have to pay higher interest rates.

Both rating agencies have been clear. The city budget is structurally unbalanced, precariously held together by one-time funds, with minimal reserves for unanticipated needs. And, because of the downgrade, the situation will get worse.

That's because the city, as part of one of its bond packages, hedged against rising interest rates in an arrangement with JPMorgan Chase. The Moody's downgrade allows JPMorgan to exercise an option to end the deal and force the city to pay a $33 million termination fee. City officials and consultants are trying to negotiate a way to soften the blow.

They essentially have until Dec. 1, the date S&P has set for consideration of another downgrade. If S&P dings the city again, a second similar hedge deal could blow up, costing the city potentially another $25 million.

Of course, those are merely symptoms of a systemic fiscal disease. The city has the greatest ratio of debt to operating revenues of the 68 cities Moody's rates. And it has the lowest ratio of cash reserves, by far.

Lindsay and especially Butt have spent far too much time whining about Moody's rather than addressing the problem. They need to start hearing the message, which is coming from multiple sources.

S&P cited the city's "weak management" and "the lack of a plan in place that is sufficient to address the city's ongoing structural imbalance."

The city's bond counsel, John H. Knox, was unambiguous. In recent years, the city has "burned away a lot of cash," he said last month. "It is important that the expenses of the city be reined in to the amount of revenues you have."

The city's financial adviser, Jocelyn Mortensen, in May warned Lindsay of "potentially catastrophic financial consequences," and urged the city manager to warn his council "of the very real consequences of inaction or half-action."

Sadly, no one is reaching for the brakes. Facing heat from creditors, Richmond tries to shore up financesBy Karina Ioffee kioffee@bayareanewsgroup.com

Posted: 11/12/2015 04:01:29 PM PST | Updated: 41 min. ago

RICHMOND -- City officials are facing growing scrutiny over Richmond's fiscal situation and questions about whether service cuts, layoffs and another credit rating downgrade could be on the horizon.

Earlier this year, Richmond became the only California city to have its bond rating reduced to junk status by Moody's Investors, after the credit-rating agency cited high debt obligations, growing expenses and reliance on one-time revenues as the reason for the downgrade.

The decision has already forced the city to issue new bonds at a less than favorable rate that will likely cost Richmond taxpayers an additional $10 million. The bond sale was needed to generate cash after the reduced rating gave the bond holder -- JP Morgan -- an option to end the deal, which would force the city to pay a $33 million early termination fee or face a lawsuit.

In recent months, Richmond Mayor Tom Butt has lashed out at ratings agencies, calling them debtors' prisons and the city an "abused wife." City Manager Bill Lindsay, meanwhile, has repeatedly said the city's budget is balanced, something Moody's disputes.

But many say Richmond needs to be more honest about its financial situation instead of blaming others.

"I'm sympathetic to Richmond's plight, but it's a bit like baseball players being unhappy with a referee's decision," said Alan Auerbach, a professor of economics and law at UC Berkeley. "And we have had two important municipal bankruptcies in the Bay Area -- Vallejo and Stockton -- so it's not unreasonable for ratings agencies to consider the risks to municipal governments."

Among issues raised by Moody's are Richmond's use of Measure U, the half-cent sales tax passed in 2014, to cover the budget deficit, as well as counting on the $114 million Chevron tax settlement and $3.4 million from a bond sale to fill the budget deficit. Measure U, which does not sunset, was touted as being primarily for road repairs when it was proposed last year and is projected to bring in roughly $8 million per year.

Members of the current and past Richmond City Council have also been critical of their colleagues' handling of the city's purse strings.

"We need to educate ourselves about finances because if you don't understand the problem, then you don't understand the urgency and just let things drift, voting on them based on your ideals and not facts," said Councilman Vinay Pimplé. "If we don't take measures now, it will be really bad."

Options facing the city include reducing services, laying off workers or finding some way to increase revenues in the coming years.

Former Councilwoman Jim Rogers, who lost his re-election bid last year, said he had hoped to partially address the city's fiscal crisis by using one-time funds to pay down debt on retiree health care benefits, estimated to total more than $126 million. But the idea, floated in 2014, was rejected by the majority of the council, he said.

"I thought that was a reasonable approach, pay down our debt and not decimate city services, but the others did not agree with me," Rogers said.

In general, Rogers does not believe the council has gone far enough to address long-term financial needs, although he rejected any comparisons to 2004 when the city faced a $35 million deficit and was forced to lay off 300 employees.

Councilman Nat Bates has also been critical of the city's handling of the budget, although he declined to comment this week, saying he would share a statement at Tuesday's council meeting.

At that meeting, council members are expected to vote on renewing Lindsay's contract. Lindsay earned $270,572 in base salary last year, according to this newspaper's public employees salary database, and is entitled to a 6 percent increase once the contract is renewed.

But according to Councilman Jael Myrick, an agreement has been reached to peg Lindsay's raise to whether he can achieve certain financial goals for the city. Among them: boost the city's reserves to 12 percent, or $17 million, up from $10 million; achieve a structurally balanced budget; and do it all without laying off any city employees.

"There is no easy thing we can do because there isn't a lot of waste," Myrick said. "If we start cutting, we're going to have to cut police officers, firefighters or libraries or employment and training or the arts, programs that people rely on. People need to understand what that means."

Councilwoman Jovanka Beckles said she was still trying to "grasp the situation" but added that she wasn't panicked and trusted Lindsay's leadership. Eduardo Martinez did not return calls for comment.

In an email, Councilwoman Gayle McLaughlin said that she believed the city had a balanced budget and was living within its means. At last month's council meeting, she also praised the city for being "creative" with how it has dealt with its fiscal troubles.

"I don't think this council has made poor decisions, and we have made cuts," she said at the Oct. 6 meeting. "But I don't want our community to suffer. Austerity is not the answer."

That prompted Pimplé to retort that creativity was fine for writing a novel but not for balancing the budget.

"Just patting ourselves on the head and saying we've been creative and innovative ... that's when a red flag should go up," he said.

Contact Karina Ioffee at 510-262-2726 or kioffee@bayareanewsgroup.com. Follow her at Twitter.com/kioffee

Richmond Councilmember Vinay Pimple pushes for fiscal transparencyNov 12, 2015

On March 17, just two weeks after becoming Richmond City Council’s surprise pick to fill Mayor Tom Butt’s vacated council seat, Vinay Pimple (pictured), a political outsider welcomed to City Hall for his calm pragmatism, took issue with a low-priority agenda item regarding a memorial plaque at Nevin Community Center.

City staff had pegged the cost of the plaque, which was to be placed on an existing park bench, at $4,000, including installation and upkeep. In a city with a $144 million budget, a debate of any length over $4,000 might not seem like a valuable way to spend council’s time. Surely there are bigger fish to fry. But after Pimple expressed doubt about the plaque’s cost, a lengthy debate indeed followed.

Pimple may be a fresh face in Richmond’s political scene, but he has not been shy about pointing out challenging fiscal decisions of any size, and in fact his dogged insistence on fiscal transparency since his council appointment has even grated upon council colleagues. Some members believe most budget decisions, which are indeed complex, should be left to the financial experts on city staff.

But recent news about Richmond’s vulnerable financial situation reveals that all along, Pimple has been frying the city’s biggest fish. Back in June, while council grappled over rent control and a space weapons ban prior to passing the 2015-16 budget, Pimple was one of the only members who focused less on the merits of such policies than their cost to the city’s general fund.

He had reason for concern. Bond-rating agency Moody’s noticed what Pimple was growing to understand in his new role on council: the city was struggling to balance its budget and it wasn’t clear that enough was being done to rectify it. While cuts were made in the city’s spending, the city still had to use all proceeds from Measure U, a tax promised for sustained road repair, toward plugging up a $9 million deficit.

Richmond’s fiscal troubles prompted Moody’s to downgrade the city’s issuer rating in both May and August. The downgrade was costly, resulting in a $30 million bond termination fee for the cash-strapped city. Without swift action to respond to the downgrade, the city could face another downgrade, this time by Standard & Poor’s, which could cost the city another crippling $25 million bond termination fee.

In order to prevent further fiscal pain, the city plans to issue additional bonds to refund some of the related pension bonds and also to pay the termination fee. Public finance attorney John Knox warned the financial markets’ concerns stemmed from the city over-spending revenues on an annual basis and having “an extremely thin margin of error in its budget.”

One would think such terrible financial news would have dominated council’s attention. And yet, Pimple’s proposal to launch into more discussion on the topic faced resistance at the latest City Council meeting.

During the meeting, Pimple suggested that staff present financial information to council on a more regular basis, rather than only during budget season. More immediately, he pushed to ensure that city staff would present how the city can prevent a future credit rating downgrade by S&P.

“That is part of what I want to change — to have different financial items put on study session every month so that everyone in council is more aware of the city finances,” Pimple told the Richmond Standard. “What tends to happen is every year, we work on financial items only when we need to. Whatever the city manager puts forward is OK’d…without an understanding of what the city’s finances are. Personally I don’t think that’s a good way to go.”

The request, says Pimple, is not an affront on city staff’s ability to handle finances, but rather an effort to empower council members – as well as the public – to make informed choices during meetings.

Some councilmembers either don’t believe Moody’s fairly judged Richmond, as Mayor Tom Butt has suggested, or would prefer to kick the financial can down the road, as Pimple believes.

Pimple resisted suggestions that the city wait until January to revisit the city’s financial future or until City Manager Bill Lindsay presents results from a 5-year financial forecast.

“My issue is, did the councilmembers know in April that [Richmond was] four months away from junk bond status?” Pimple said.

It is true, Pimple says, that a councilmember may not have the financial expertise nor the time to thoroughly understand every last expense – such as the reason a simple plaque on a park bench would cost $4,000. And Pimple admits the city is short-staffed due to cuts, although he’s unconvinced that every effort to identify savings and efficiencies have been exhausted.

In the least, Pimple argues, a better financial understanding could fundamentally change the focus of council meetings. Perhaps proposals such as rent control, a policy debate that has been primarily about renters protections, could equally be about whether the city can afford such a policy change, he says.

Pimple also points to expertise from the Richmond public, which includes a number of smart money managers, as a possible asset for the city’s financial future.

“When the public is more aware of the financial situation, they can understand when we take those measures,” Pimple said. “If you don’t tell them anything at all [until it’s time to approve a budget], people think everything is fine.”

Pimple’s nagging financial requests on council, however, are catching on with fellow members. Councilmember Eduardo Martinez was among those defending Pimple’s call for financial transparency.

“I do believe that for us to be the quality council members that we strive to be, the more information we have, the better our decisions will be,” Martinez said. I also believe that having these sorts of conversations in public not only informs us…but it helps the public understand how the city runs and gives them a better appreciation of the immensity of the job that we have.”

And who knows? Council members may be able to discover – or at least enforce – efficiencies in the budget. After discussing the cost of the park bench plaque, council learned it could be done for under $1,000, achieving a 75-percent savings.

That result, however, still failed to satisfy Pimple, who had heard the job could be done for as low as $60.

“We need to learn to live within our means,” he says.

|

|